extended child tax credit dates

As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous. The legislation made the existing 2000 credit.

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

But others are still pushing.

. Previously the credit was 2000 per child under 17 and will revert. Visit ChildTaxCreditgov for details. H aving been included in the American Rescue Plan by the United States president Joe Biden back in March the expanded Child Tax Credit will offer qualifying families to get up.

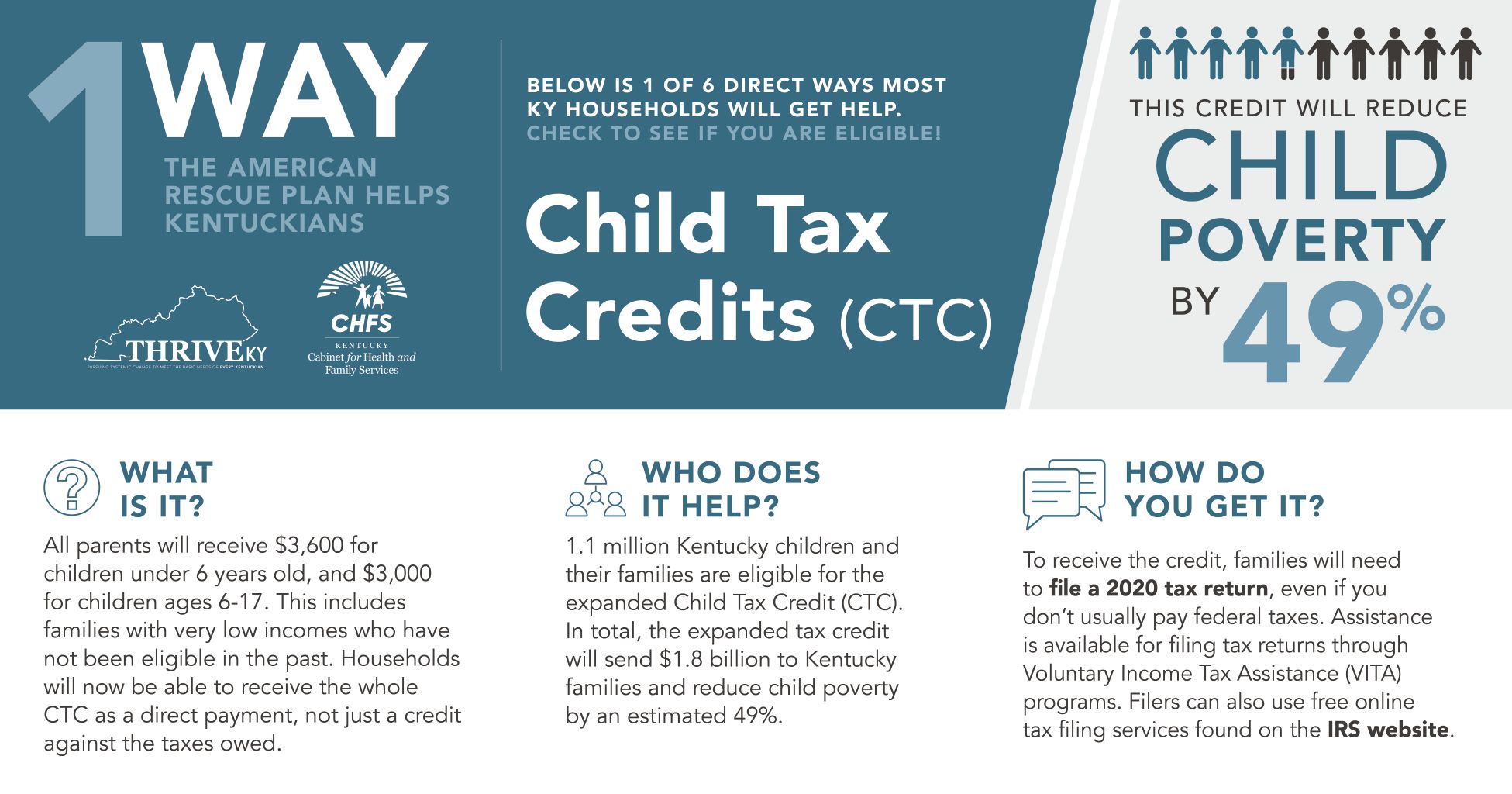

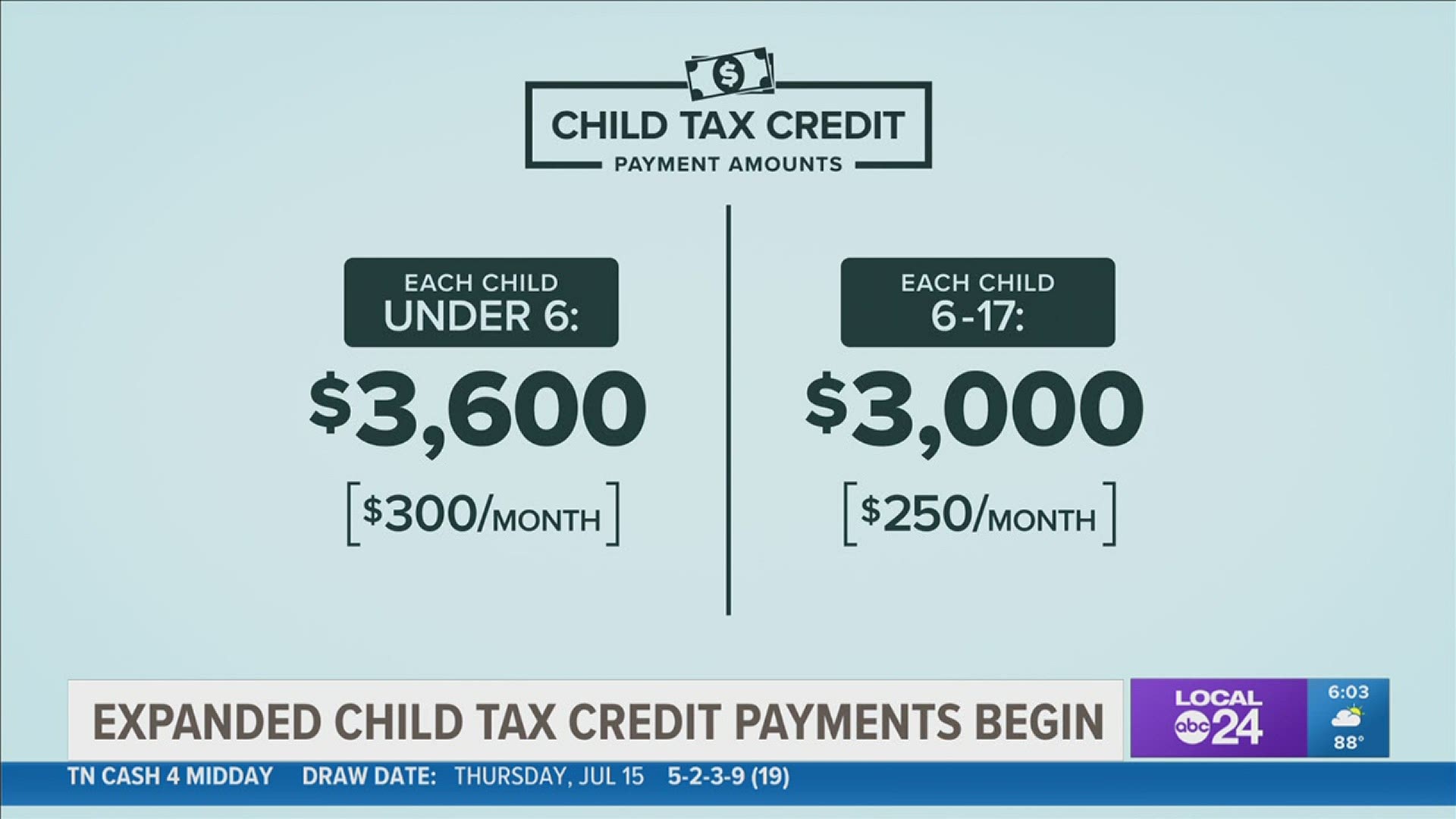

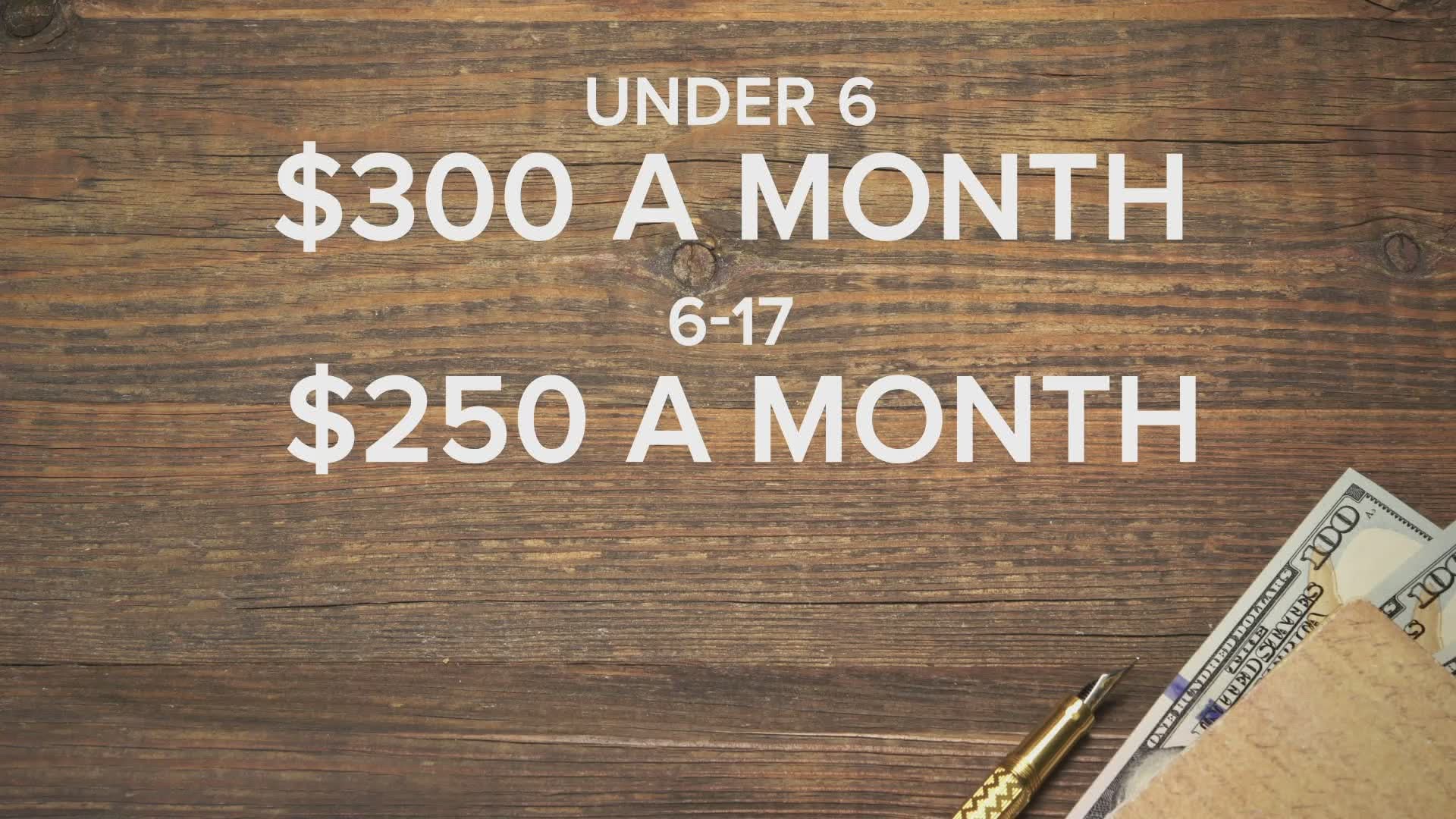

Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to. The expanded child tax credit includes up to 3600 per child under age 6 and 3000 per child ages 6 through 17. The maximum credit amount has increased to 3000 per qualifying child between ages.

Govt made an amendment to CGST and services tax Act to give more time to businesses for claiming input tax credit issuing credit notes and removing errors by extending. Advance Child Tax Credit Payments in 2021. President Joe Bidens 19tn American Rescue Plan ARP not only proposed stimulus checks of up to 1400 but also an extended child tax credit of up to 3600 per dependent for.

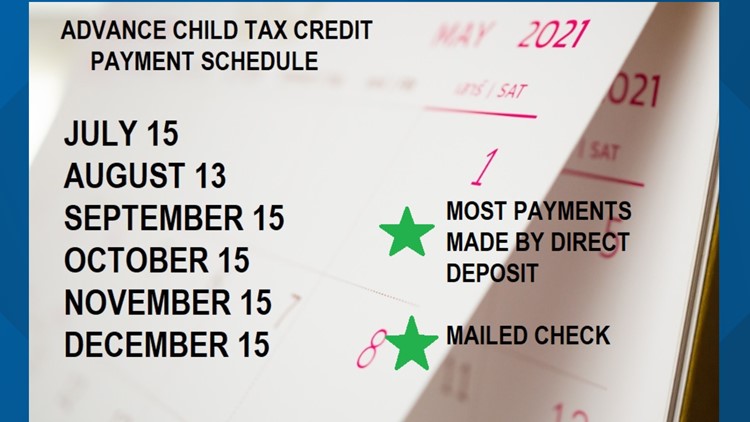

Payments for the new 3000 child tax credit start July 15. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. Not a tax deduction Half of the credit can be paid in advance between July 2021 to December 2021.

Registered for work training or full-time. Starting in January 2023 families with incomes of 75000 or less 85000 for married taxpayers filing jointly could get 5 to 30 of the federal credit for each qualifying. January 20 2022.

The monthly advance payments have ended but what will happen this year. If you havent yet filed your tax return you still have time to file to get your full Child Tax Credit. By Ethen Kim Lieser.

Theres Still Time to Get the Child Tax Credit. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. You could get extended Child Benefit for up to 20 weeks if your child is 16 or 17 has left approved education or training and has either.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. While the IRS did extend the 2020 and 2021 tax filing dates due to the. The December 28 deadline looms as Congress must come to a decision while families push for another year of 300 monthly payments.

Heres what to know. June 14 2021 The American Rescue Plan Act expands the child tax credit for tax year 2021. But if Bidens nearly 2 trillion American Families Plan ever gets green-lighted by Congress the credit could be extended well beyond this yearthrough 2025.

Theres only four days left for.

Parents Guide To The Child Tax Credit Nextadvisor With Time

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Nearly 1 Million Kentucky Children Eligible To Receive First Monthly Child Tax Credit Payment Next Month Kentucky Center For Economic Policy

What The Expanded Child Tax Credit Means To Families Localmemphis Com

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

The Child Tax Credit The White House

How Monthly Child Tax Credit Checks May Be Renewed By Congress

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Child Tax Credit Payment Schedule Here S When To Expect Checks Kare11 Com

When Will Families Receive The Advanced Child Tax Credit The Dates You Need To Know Fox Business

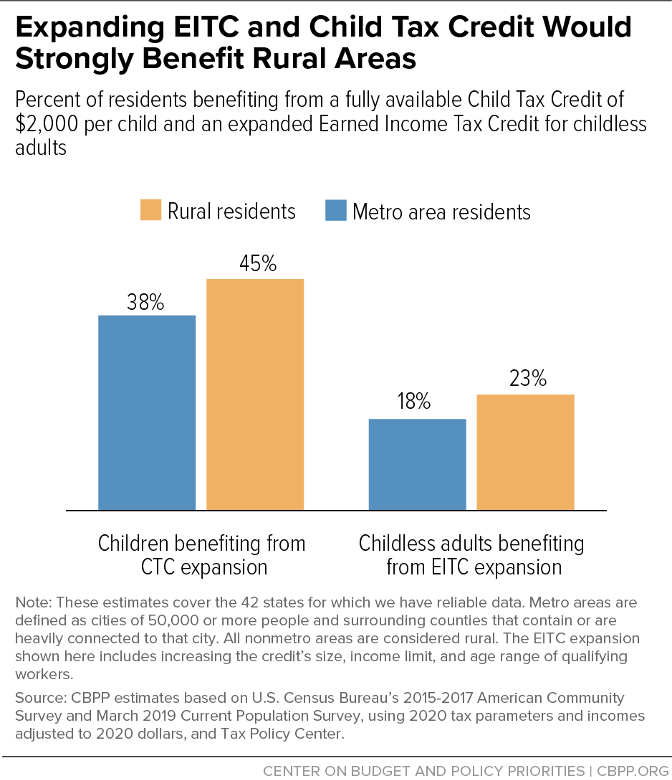

Expanding Child Tax Credit And Earned Income Tax Credit Would Benefit More Than 10 Million Rural Residents Strongly Help Rural Areas Center On Budget And Policy Priorities

What Is The Child Tax Credit Tax Policy Center

Stimulus Update Last Child Tax Credit Payment In December Important Deadline Ahead Al Com

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Irs Child Tax Credit Deadline To Extend 300 Payments Into 2022 Is In Four Days See If You Re Eligible The Us Sun